6.1 Re-emergence of poverty in Japan

Until recently, it was widely believed that Japan had solved the poverty problem. The notion that Japan had achieved economic growth and achieved an egalitarian society has sunk deep into the Japanese public consciousness so much so that it has become a source of national pride and identity. In fact, already back in the 1960s, the living standard of people was rising rapidly and problems of food shortage after World War II had become things of the past. The term “a middle-class nation” was coined to describe Japan in the 1970s and it was believed that all people, even the most disadvantaged, had benefited from the economic growth. The government stopped collecting and publishing statistics on poverty in the 1960s, and poverty dropped from the policy discourse.

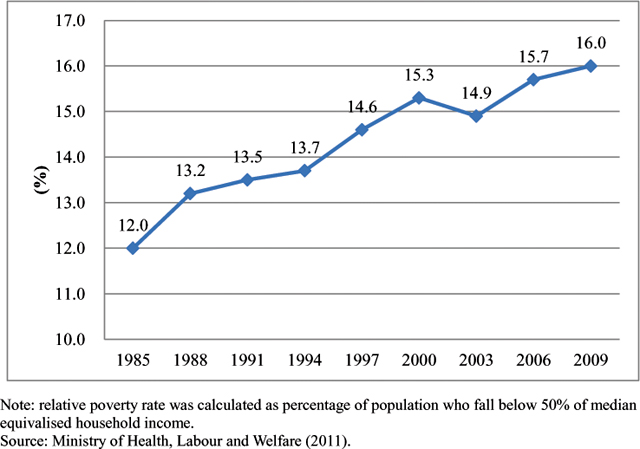

However, Since the 1970s, Japan’s poverty rate has been rising steadily. As in Figure 1, the relative poverty rate of Japan has increased 4 percentage points from 1985 to 2009, making Japan one of the top five countries among the OECD countries with a high poverty rate.

Figure 6.1 Relative Poverty Rate of Japan

The government has finally recognized the problem of poverty in the late 2000’s. In 2009, the Ministry of Health, Labour and Welfare announced the relative poverty rate and a number of measures to assist the poor started in late 2000’s and in 2014, the Law on Measures to Counter Child Poverty was enacted.

In this section, the Public Assistance program which still serves as the pillar of Japan’s policy against poverty will be described.

6.2 The Public Assistance program

6.2.1 General characteristics

The root of Japan’s Public Assistance program goes back to poor relief before World War II. Today’s Public Assistance program has its legal basis on the Public Assistance Act enacted in 1950. The Law stipulates four fundamental principles: (1) public assistance to the people in need is a responsibility of the state, (2) all citizens have a right to claim public assistance without discrimination of sex, social background, and reasons for falling into hardship, and only the economic condition is the criteria of receiving assistance, (3) the state guarantees to all citizens a minimum level of healthy and cultural life, and (4) public assistance is a supplement to all resources available and the best efforts exerted by the applicant.

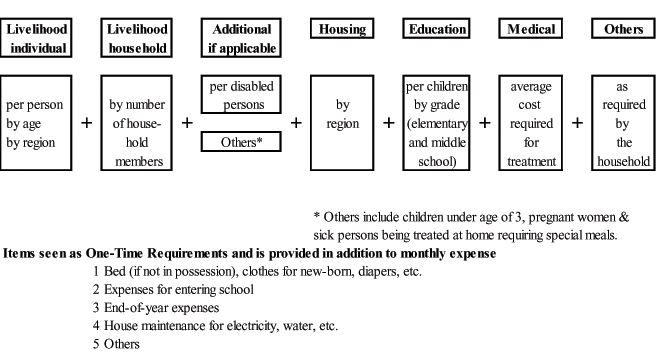

The Public Assistance is provided upon a receipt of an application from a household in need, and after a careful examination of the application. The assistance is calculated by subtracting the household’s final income from the minimum cost of living (See Figure 6.2). In case the minimum cost of living exceeds the final income, the difference is given as the assistance. The minimum cost of living is calculated from seven categories of expenses: livelihood, housing, educational, medical, maternity, occupational, and funeral expense. The calculation of the minimum cost of living takes into consideration the differences in living costs among different regions of the country, and household members’ age. All assistance is provided as cash transfers, except a few such as medical costs, which are provided as in-kind.

Figure 6.2 Determination of Monthly Minimum cost of Living

6.2.2 Means test

The principle (4) of Public Assistance states that Public Assistance must be a supplement to the person’s best efforts and available resources. In other words, the person is required to use all available resources, including assets, ability to work, as well as assistance from those who are required to support the person by law. Assets such as land, houses and farms must be sold, except in the case where the person is actually living or utilizing it and the value of the assets is higher when it is utilized than when it is sold. Household goods such as TVs are allowed if more than 70% of the population in the region possess the item.

As for the ability to work, the person will not be able to receive assistance if he/she is judged as capable to work. If the person has a will and ability to work, but is unable to find work, it is unlikely that he/she would be given assistance.

The civil law states that certain relatives and family members are required to support a person in need. Thus, public assistance is given only after it is judged that this support is not available. In practice, spouses and parents of a minor (less than 20 years old) have strong responsibility to support the person.

6.2.3 Statistics of recipients of Public Assistance

As of July 2013, 1,581 thousand households or 2,159 thousand persons (1.7% of the population) received some types of public assistance (monthly average). The share of the population receiving the assistance had declined until 1995, but since then there has been a continuous rise. Among those receiving assistance, elderly household make up the largest share, accounting for 45.2% of all recipient households, and has been increasing for some years. The share of households with a disabled or sick individual is also large, at 29.4%. About 7.0% are single-mother households, and the rest, 18.3%, are classified as “other types of households.” The large share (87.5% in 2010) of households who receive Public Assistance have no working household members.

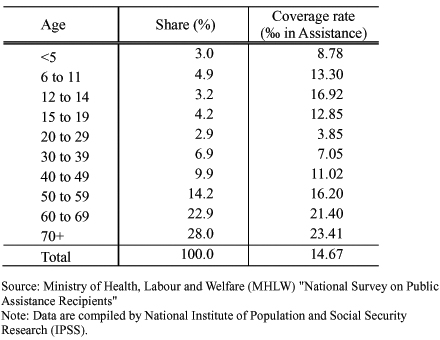

By age, those above 70 years old comprise the largest share (28.0%). Those between 60 and 69 years of age also consist 22.9% of the recipients. The elderly in general have high coverage rate (i.e. % of those who are recipients of Public Assistance among the general population of that age group). Little more than 2.0% of the elderly above 60 years old are the recipients of the assistance, where only about 0.88% of the children aged less than 5 and 0.39% of those aged between 20 to 29 years old were the recipients (Table 6.1).

Table 6.1 Break-down by age, Public Assistance Recipients (2010)

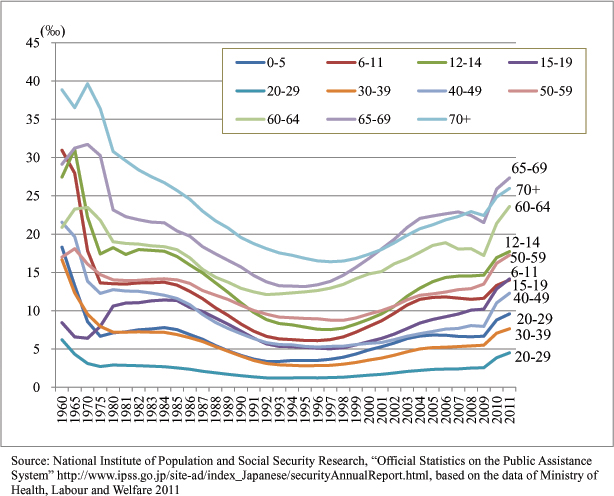

Figure 6.3 shows the number of recipients by age groups. The number of recipients dropped sharply after the 1960s in all age groups, reaching an all-time low in the mid-1990s, and increased again from the late 1990s to 2011. The sharpest increase in the number of recipients was seen in the 65 to 69 age bracket.

Figure 6.3 Percentage of those receiving Public Assistance, by age (1960-2011)

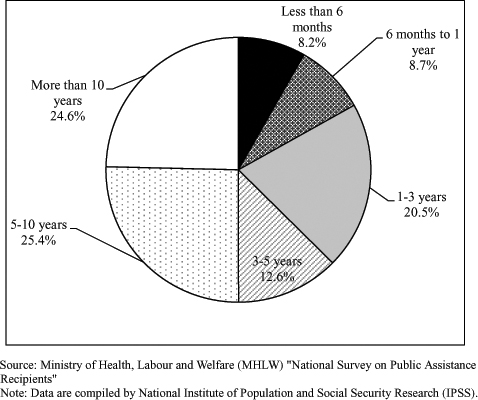

Figure 6.4 shows the duration of receiving the assistance, and while those who have been receiving for less than a year comprise nearly 17% of recipients, those who have been receiving for more than 10 years also comprise nearly 25%. The duration tends to be long because the majority of the recipients are elderly and there is not much prospect of them finding work.

Figure 6.4 Duration of Receiving Public Assistance

6.3 Current Issues

6.3.1. The 2013 Reform of the Public Assistance

The Public Assistance is one of the oldest programs among social security system in Japan. The recent upward trend in the number of recipients and expenditure of Public Assistance has become controversial, and the Public Assistance program has become one of the main targets for budget restraint in the policy debate. One of the criticisms of the program was that the benefit level is too high, compared to the income level of people who do not receive Public Assistance benefits. For example, the benefit level for single-mothers was pointed out to be higher than many single-mothers who are “managing on their own.” While many scholars argue that this is not the problem of the benefit level, per se, the problem is the fact that many people do not receive the benefit even though their income level is so low (i.e. the take-up rate of the program is rather low. The take-up rate is the percentage of those who are actually receiving the benefit among who are eligible to receive the benefit.). The government had demolished the additional benefit which was previously given to single-mothers and elderly households by March 2007. However, the benefit for single-mothers was reintroduced in December 2009. From August 2013, the government decided to reduce the amount of Livelihood assistance, the major component of the minimum standard of living, by as much as 10% for some households, to compensate for the declining consumer price index. There is a wide spread outcry against this measure.

6.3.2 Emerging policies toward poverty alleviation

There have been a number of policy initiatives which target the poor in recent years. One of which, the Law to Assist those Experiencing Hardship (生活困窮者支援法), was debated extensively in 2012 and 2013, and was enacted in 2014. This law aims to establish comprehensive welfare service offices throughout the nation. It is intended as a one-stop service provider for those in need. Another initiative is the enactment of the Law on Measures to Counter Child Poverty as previously mentioned. It mandates the Japanese government to plan comprehensive policy to combat child poverty and to implement the plan. It states as the guiding principle that the aim of policies to combat child poverty is to realize a society in which a children’s future is not influenced by circumstances in which they are born into. The law calls for basic policy framework to be enacted by the Committee on Combating Child Poverty which will be assembled within a year after its enactment, and mandates the government to announce the state of child poverty and policies every year.

Note:

1. The Public Assistance Law (New) excludes foreigners from this right, but currently, by order, legal foreigners are given “equal treatment as citizens”. Illegal foreigners are not covered.