Although Japan’s unemployment rate continues to remain at a relatively low level compared to other advanced countries, it has gradually risen since the late 1990s. The length of job tenure that used to be regarded as one of the characteristics of the Japanese labor market has also declined in recent years1. As stable jobs have decreased, there is a growing need for support for unemployed persons. This chapter lays out two social security programs: Employment Insurance and Workers’ Accident Compensation Insurance. In Japan, the term “Labour Insurance” is used to indicate these two social insurances. Schemes of the two insurances are independent of each other, but both have similar characteristics in that the government is the insurer, and the prefectural labour bureau collects the insurance premiums.

Social Security in Japan 2014

Chapter 9 Labour Insurance

9.1 Overview

9.2 Employment Insurance

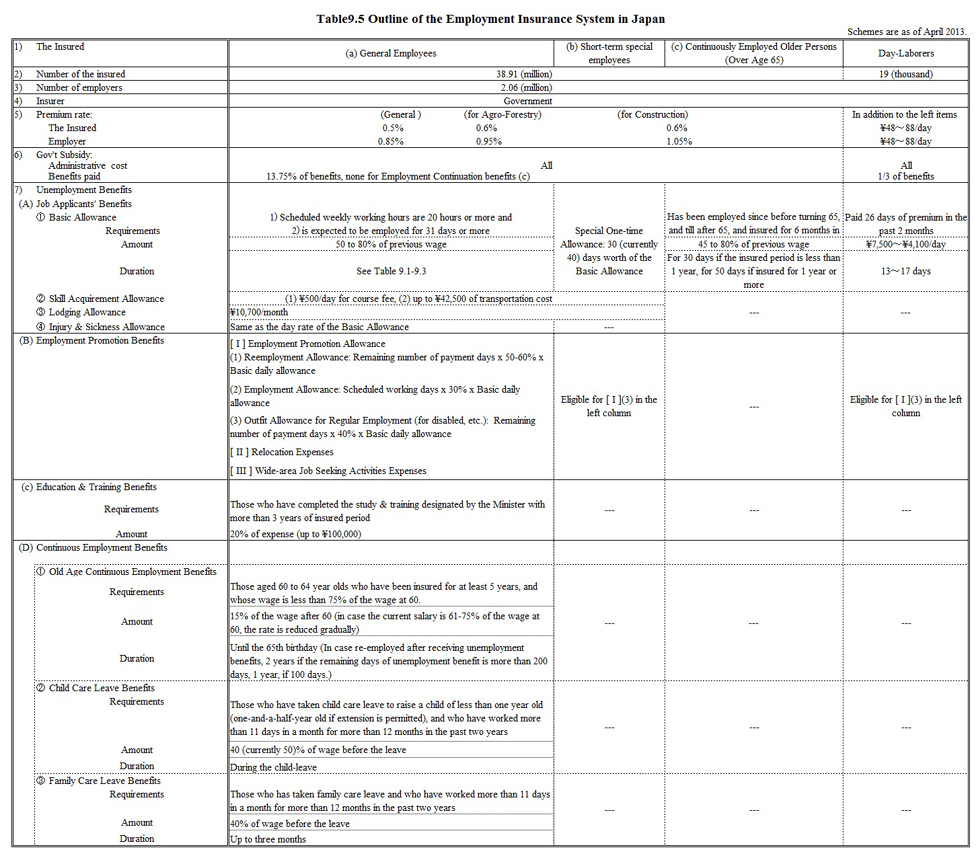

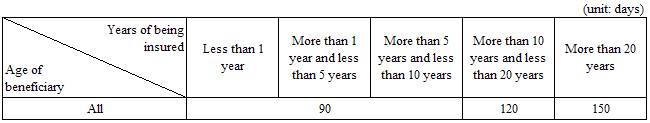

Employment Insurance consists of three main pillars: unemployment benefits, service for employment stabilization, and service for developing human resources. Through the unemployment benefits, cash benefit is provided in case an employee loses the job, which can be used as livelihood support, and for the promotion of reemployment. The unemployment benefits include a variety of benefits such as the Job Applicants’ Benefits, Employment Promotion Benefits, the Education and Training Benefits, and the Continuous Employment Benefits. These items are further explained below. The service for employment stabilization is provided to support employers to prevent them from laying off their employees. The service for developing human resources assists both employed and unemployed persons to acquire skills. The entire scheme is shown in Figure 9.1.

Since April 2010, any employee 1) whose scheduled working hours are 20 hours or more per week and 2) who is expected to be employed for 31 days or more, is considered as insured under the employment insurance.

The employment insurance is funded by both insurance premium and tax revenue. The insurance premium is paid in principle by both the employer and employee. Based on a balance of expenditure and revenue, insurance premium is determined systematically within a defined range, with the approval of Minister of Health, Labour and Welfare2.

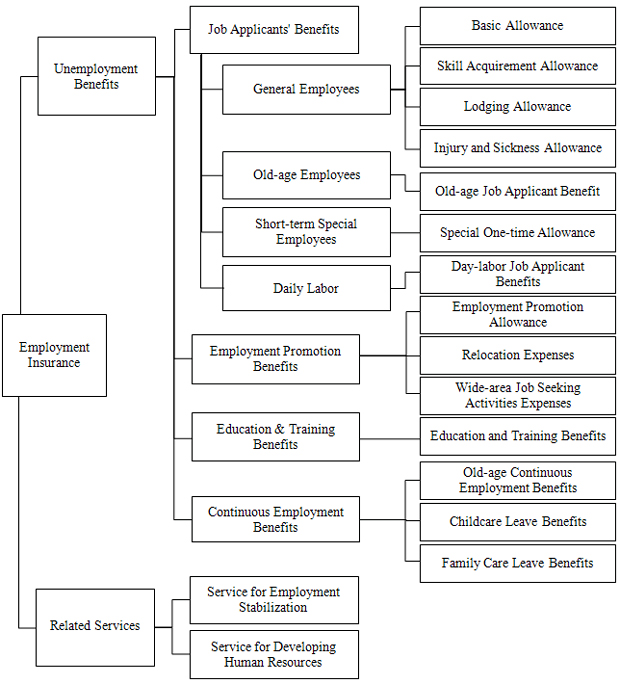

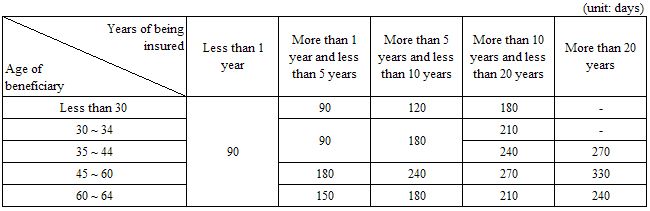

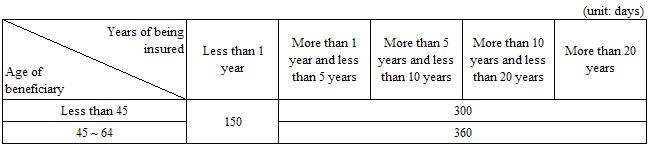

The Basic Allowance is one of the Job Applicants’ Benefit, and the most common benefit of the employment insurance3. The basic allowance is paid when the insured former employee lost his/her job. The benefit payment period of the basic allowance is between 90 and 330 days4, and varies by reason for unemployment, insured period, and age of the beneficiary. The benefit period is basically longer if the insured period is longer. If unemployment is due to “company bankruptcy,” or involuntary leaving such as “termination,” or “expiration of contract term,” the benefit period is basically set longer than unemployment due to other reasons and is set longer with higher age (excluding people aged 60 or older). The Tables 9.1 to 9.3 show the number of days the allowance is paid for each kind of recipient.

In case of job separation for his/her own reasons, benefits start approximately three months after the unemployment (if the person is still unemployed at that time). The benefit amount is 50 to 80% of the average wage for the six months prior to unemployment (45 to 80% for persons aged 60 and 64), and the rate is higher if the wage prior to unemployment is lower.

In the fiscal year 2012, an average number of those who received the job applicants’ benefit per month were 576,000, and the total amount of the benefit payment was approximately 930 billion yen.

Employment Promotion Benefits are paid for those who are finding regular jobs and non-regular jobs. Those qualified to receive the basic allowance and are successful in finding employment with a certain benefit period remaining are eligible to receive these benefits.

Education and Training Benefits are paid to those who have been covered by employment insurance for a certain period when they attend and complete education or training that is provided by the private sector and designated by the Minister of Health, Labour and Welfare. It compensates 20% of the education and training expenses (up to \100,000).

The Continuous Employment Benefit has three programs: Old-Age Continuous Employment Benefits, Childcare Leave Benefits, and Family Care Leave Benefits. The Old-Age Continuous Employment Benefit is provided to insured persons aged 60 to 64 years old who have been covered by the employment insurance for five years or more. If a person’s wage drops to less than 75% compared to the wage at age 60, then up to 15% of the monthly wage is paid. The benefit period is provided up to the 65th birthday.

The childcare leave benefit is a benefit for insured persons taking childcare leave to care for infants under the age of one (or the age of one and a half if extension is permitted). They receive benefits equivalent to 50% of the wage before taking leave (with an upper limit), assuming that the person was insured for a certain period prior to the start of the leave. In the past, part of the benefit was paid six months after returning to work, but the benefit is currently paid in full during the leave.

The family care leave benefit, as in the case of the childcare leave benefit, is a system for those taking leave to provide nursing care for his/her family. The benefits are equivalent to 40% of the wage before taking the leave (with an upper limit) for a maximum of three months.

9.3 Workers’ Accident Compensation Insurance

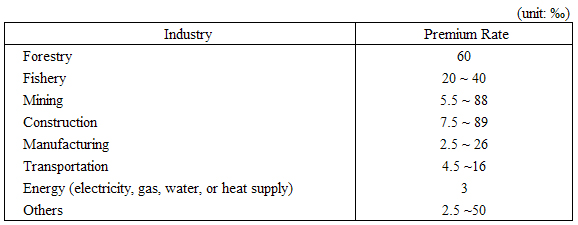

The Workers’ Accident Compensation Insurance is a system to provide benefits to compensate for workers’ injury or sickness while at work or commuting to and from work. It also has programs to promote the social rehabilitation of the afflicted worker. All employees regardless of employment type or business size are covered by this insurance, which is in principle funded by premiums paid by employers. The premium rate varies greatly by industry as shown in Table 9.4. For firms with more than 100 employees, the premium increases or decreases, based on the number of accidents caused in the firm for the past three years.

Benefits include medical treatment (compensation) received at medical institutions, temporary disability benefit to compensate for wages during the treatment period, injury and disease benefit or physical disability benefit for injuries/diseases that are not cured or leave disabilities, and survivors benefit paid to the family in case a worker dies due to a work-related reason.

9.4 Current Trends

Since the employment insurance were amended several times to expand eligibility for being insured to non-regular workers from the relatively early days, the proportion of insured persons to all employees remains at approximately 70% despite the recent rapid increase in non-regular workers5. Nevertheless, the recipient rate (ratio of those who receive unemployment benefits to all unemployed persons) has consistently declined since the enactment of the current unemployment insurance law of 1975, and has been below 30% in recent years. This long-term decline is attributable to the increase of the number of those who were employed only for a short period, and therefore did not meet the required insured period before becoming unemployed, as well as the government’s policy of aiming to reduce unnecessary claims for benefit6. Against this backdrop, in October 2011, the government introduced Job Seekers Support System which offers job training and allowances to unemployed persons who are ineligible for unemployment benefits, or whose benefit period has expired, relying on the employment insurance fund.

1. Japan is believed to be a country in which it is the most difficult for employers to fire their employees owing to the regulations for protecting workers, but whether the regulations are actually strict or not is still debatable.

2. The insurance premium does not vary by individual firm.

3. It is often referred to simply as the “Unemployment Benefits.”

4. For those difficult to get employed such as disabled persons, the benefit period is between 150 and 360 days.

5. Also in recent years, expected period of employment required for being insured, which used to be one year, was shortened to 6 months in April 2009, and 31 days in April 2010.

6. Another factor behind this decline is the increase in the number of those who have been unemployed for a long period, and therefore have exhausted the benefits.