5.1 Overview of the Welfare for the Elderly

Before the enactment of the Act on Social Welfare for the Elderly in 1963, welfare for the elderly had been mainly to accommodate frail elderly persons in asylum under the public assistance system. The Act of 1963 aimed to maintain physical and mental health of the elderly and to stabilize their livelihoods, and various welfare services for the elderly including intensive care homes and home help services were developed during 1960s. As free healthcare for those who were 70 years old and over was introduced in 1973, healthcare expenditure for the elderly expanded, and increased a financial burden on the government. The Health and Medical Service Act for the Aged in 1982 started to impose copayment for healthcare on the elderly, and also emphasized the importance of health promotion from the middle aged over 40 years old.

Around the same time, more people were getting aware of the problem of “social hospitalization” and bedridden elderly, which means that the elderly tended to be hospitalized even after their conditions no longer required medical care, because long-term care facilities and services were not enough and co-payment of these facilities were more expensive than that of the hospitals. In order to tackle this problem, in 1989 the Ministry formulated the Gold Plan (10-year strategy for the promotion of health and welfare for the elderly) so as to promote urgent development of care facilities and in-home services, and it was revised in 1994 as the New Gold Plan (new 10-year strategy for the promotion of health and welfare for the elderly), which enhanced home based care and led to argument of new long-term care system for the elderly.

Starting in April 2000, Japan introduced the Long-Term Care Insurance. This social insurance system covers the long-term care of the elderly, which was previously provided partly through the health insurance system and partly by the welfare measures for the elderly. The Long-Term Care Insurance grew out of the recognition that, due to changes in the society such as weakened community ties, increase in small-sized families, and increase of working women, financial and psychological burden of family facing the care for the elderly has become unbearably large. Furthermore, there was the limit of service provision under the existing health and welfare system because of increasing number of the elderly requiring long-term care for longer periods. The Long-Term Care Insurance is designed to share the burden of caring for the elderly among all members of the society.

5.2 Long-Term Care Insurance System

5.2.1 Principle of the Long-Term Care Insurance System

There are three basic principles for the Long-Term Care Insurance; support for independence, user-oriented system, and social insurance. Firstly, the system does not intend to simply provide personal care to the elderly who need long-term care, but emphasizes supporting the independence of them. Secondly, service users can receive comprehensive health, medical, and welfare services from diverse agents based on their own choices. Thirdly, those who are 40 years and over are compulsorily insured, and thereby the relationships between benefits and contributions are made clear, and the stigma of welfare services is removed.

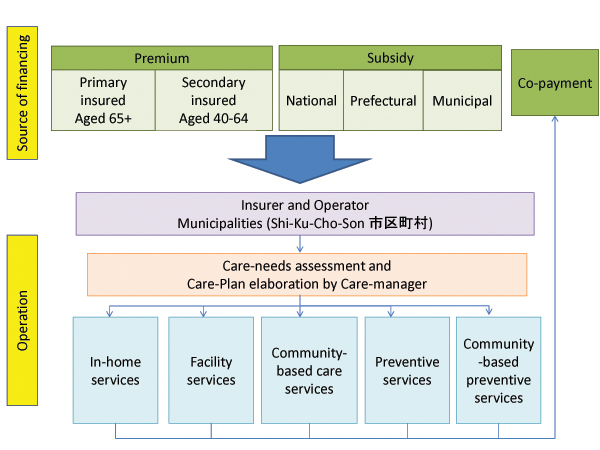

5.2.2 Insurer

Municipalities and special wards (hereinafter referred to as simply “municipalities”) are the insurers, because they have been engaged in health and welfare services for the elderly, and were expected to deliver services in harmony with community values. Insurers collaboratively work with the national government, prefectures, medical care insurers, and pension insurers, and take the role of (1) collecting insurance premiums, (2) managing fund, (3) assessing care needs, and (4) paying remuneration to service providers through a prefectural health insurance organization. For the sake of fiscal stability and administrative efficiency, some smaller municipalities organize an extended association as a regional insurer.

5.2.3 Insured

The primary insured persons are those who are aged 65 and over (Category I), and the subscribers of health insurance whose age are 40 to 64 years old are the secondary insured persons (Category II). Currently, about 29.86 million persons are subscribed as Category I and about 42.99 million persons, as Category II (as of the end of FY 2012). The premium is collected through municipality and deducted from pensions for the Category I, and through additional premium to be paid to health insurance for the Category II. Premium amount of the Category I is determined by each municipality, and thus differs from a municipality to another. Premium is income-related, and there will be measures to moderate the burden for low-income persons.

Those eligible to receive long-term care are all persons in Category I who are certified as requiring support or long-term care based on the Certification of Long-Term Care by the Certification Committee. Meanwhile, for Category II persons, care is limited to those requiring long-term care or support due to age-related diseases (=specified diseases) such as dementia and cerebrovascular disorder.

5.2.4 Service provision

Services provided by the Long-Term Care Insurance are mainly divided into two categories, preventive services and care services. Preventive services are provided for those certified as Support Level 1 or 2, and care services are for those certified as Care Level 1-5.

Types of preventive services include home-visit care, outpatient rehabilitation service, and short-term stay at a care facility. Types of care services include in-home services such as home help service and day care, and facility services such as intensive care home, long-term care health facilities, and sanatorium-type care facilities, and community-based services such as home-visit at night, day care for dementia patients, and small-sized multifunctional in-home care. According to the level of care needs, users can choose the type of services and providers, either publicly or privately managed.

5.2.5 Source of financing

The cost incurred in the Long-Term Care Insurance is financed by premiums, public expenditure, and co-payment of users. Apart from the co-payment of the users, the cost is financed 50% by premiums (21% by Category I, 29% by Category II) and 50% by public expenditure (for in-home services 25% by national treasury, 12.5% by prefectures, and 12.5% by municipalities, and for facility services 20% by national treasury, 17.5% by prefecture and 12.5% by municipalities). Within this framework the municipality can determine the rate of premium for the insured of Category I. The premium for Category I is charged based on total income of the insured, and reviewed once every three years. It was around \2,900 per month on average in 2000-2002 then the amount increased to \4,972 in FY2012-2014. For the Category II insured the rate will be 1.55% of salary and annual bonus in case of the Japan Health Insurance Association.

As a fiscal support for municipalities, prefectures set up the Fiscal Stability Foundation (financed from national treasury, prefecture and municipality) to give a temporary loan or grant when insurance budget deficit occurs because of more-than-expected service increase and unpaid premiums.

Figure 5.1 The overview of the Long-Term Care Insurance

5.2.6 Assessment of the care-needs

The users are classified into seven categories (“Support Level 1 and 2” and “Care Level 1 to 5”), depending on the severity of the care need. The limit of services provided is determined according to these categories. The user must be assessed by the municipality into one of the categories before applying for the services. For example, when a person faces a condition requiring support or care, the person or a family member must first submit an application for a long-term care requirement certification to the municipal office. Upon receipt of this application, a municipal investigator visits the applicant’s home for an interview on the physical/mental state, and aspects of daily life. The interview results are analyzed based on computer system so as to generate a preliminary assessment.

This assessment and opinion letter of the primary physician are then reviewed by the Certification Committee of Long-Term Care Needs, comprised of health, medical, and welfare experts. This Committee conducts a secondary assessment and decides the required care/support level. The municipality notifies the applicant about the decision. Applicants who are not certified as requiring preventive or care services covered by the long-term care insurance can be eligible to receive long-term care prevention services under the community-support project conducted by the municipality.

5.2.7 Care Management

Once the care (support) level is decided, a personal Care Plan is created, which combines packages of care and support within the limit of services for each category. The creator of the Care Plan varies depending on the category. The Care Plans for those eligible to receive care services and requiring care level 1 to 5 are created by Long-Term Care Support Specialists (Care Managers) at in-home long-term care support businesses or care facilities. The Care Plans for those eligible to receive preventive services and requiring support level 1 to 2 are created at Integrated Community Care Support Centers (地域包括支援センター).

The Integrated Community Care Support is a scheme created in line with the emphasis on the preventive services when the law was revised in 2005. It serves as the center for elderly care, and is responsible for care management to prevent long-term care, creating Care Plans for preventive long-term care services, providing consultations to the elderly and their family, protecting elderly rights and early detection of abuse.

5.2.8 Remuneration for services

When long-term care providers deliver preventive or long-term care services for recipients, they receive remuneration for services based on the official price list of the Long-Term Care Benefit Expense, which is decided by the Minister of Health, Labour and Welfare according to a recommendation of Social Security Council. The price list consists of in-home long-term care/preventive services and facility services, and is revised every three years. 90% of a price is paid to a provider through a prefectural health insurance organization, and 10% by recipients as the co-payment.

5.3 Current Issues in the Long-Term Care Insurance

5.3.1 Financial Strain and the Reform of FY 2011

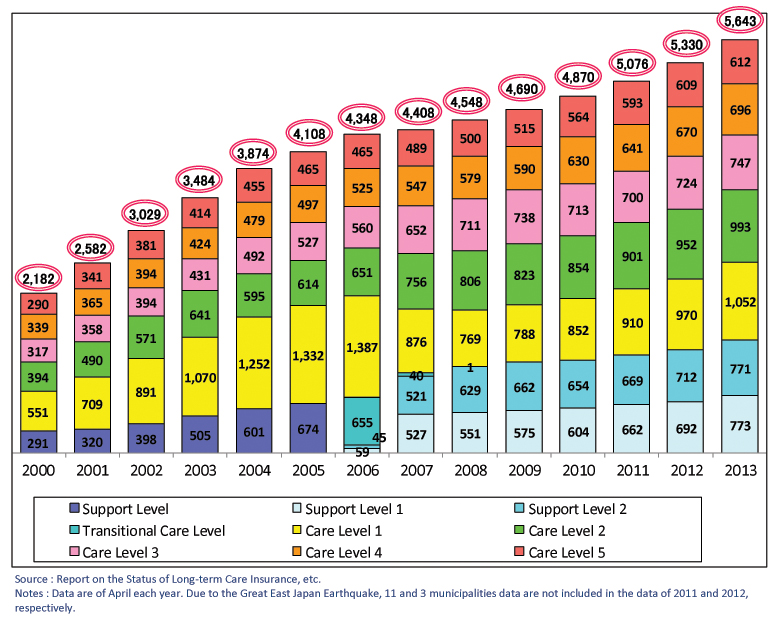

Soon after its enactment, it has become evident that the initial financial arrangement was not enough to meet the cost of the long-term care. As shown in Figure 5.2, the number of persons certified for the long-term care increased by more than 140% from 2000 (2.18 million) to 2013 (5.64 million). The number of care recipients also grew from 1.49 million (0.52 in facilities and 0.97 in-home care) in September 2000 to 4.80 million (0.88 in facilities, 3.56 in-home care and 0.35 in community-based services) in September 2013. The financial outlay grew steadily from \3.6 trillion (2000) to \8.2 trillion (2011).

Figure 5.2 The number of persons certified for the long-term care by care/support level (in 1,000)

With such circumstances, the long-term care insurance was reviewed and several reforms were put in place. The recent reforms in 2011 aimed to construct an integrated community care system which provides seamless supports comprised of healthcare, long-term care, prevention, housing, and livelihood support services, and to achieve sustainability of the system with a balanced relationship between contributions and benefits. The Act for Partial Revision of Long-Term Care Insurance refers to (1) enhancing collaboration between health and long-term care, (2) securing human resources for long-term care and improving quality of services, (3) improving housing for the elderly, (4) promoting measures to support people with dementia, (5) enhancing functions of insurers and promoting their autonomy, and (6) mitigating increase of insurance premium.

5.3.2 Establishment of an integrated community care system

The long-term care insurance system initially aimed to support the independent living of the elderly, and even if the elderly entered a state that required long-term care, it aimed to develop an environment where the elderly could receive treatment in the community with which they were familiar. To this end, the 2005 revision in the law established community-based care services and Integrated Community Care Support Centers to ensure enhanced services and coordination at the municipality level.

However, the target has not achieved, as many issues remain such as elderlies having to enter a care facility even if they requested in-home care due to non-availability of proper service providers in the familiar community, lack of collaboration between medical institutions, care facilities, and in-home service providers, and insufficient number of elderly-friendly housing.

The integrated community care is defined as a community-based system that can appropriately provide various support services including healthcare, long-term care, prevention, housing, and livelihood support within daily living spheres in order to ensure safety, security, and health of people. The area of community is generally regarded as that accessible within 30 minutes, which are almost as large as junior high school districts. To establish this system, the following five aspects of action were set up: (1) enhancing collaboration with medical facilities, (2) improving and enhancing capacity and flexibility of long-term care services, (3) promoting prevention, (4) ensuring advocacy and livelihood support services such as meals provision service or housework assistance, (5) constructing and improving elderly-friendly housing. Central and local governments are involved in coordinating all the related programs to realize people living in the familiar community independently as long as possible.

5.3.3 Securing human resources of long-term care

The number of care workers has increased since the start of the Long-Term Care Insurance System, and it reached approximately 1.33 million workers (head count) in FY2010, increased sharply from 0.55 million (head count) in FY2000. Although the number has grown, long-term care providers always suffer shortages of long-term care human resources, as the demand for services continuously increase. It is regarded as a big challenge to secure the necessary personnel, and to improve their working environment. Basically, a majority of workers are female in the long-term care services, and most of them work part-time especially for in-home services, while most workers in facilities are full-timers.

In order to raise their wages, the Ministry took several measures such as additional payments for long-term care providers to improve working conditions. Providers can receive additional payments, if they could meet the requisite of improvement programs including a pay raise plan.

5.4 Welfare for the elderly other than the Long-Term Care Insurance

5.4.1 Housing for the elderly

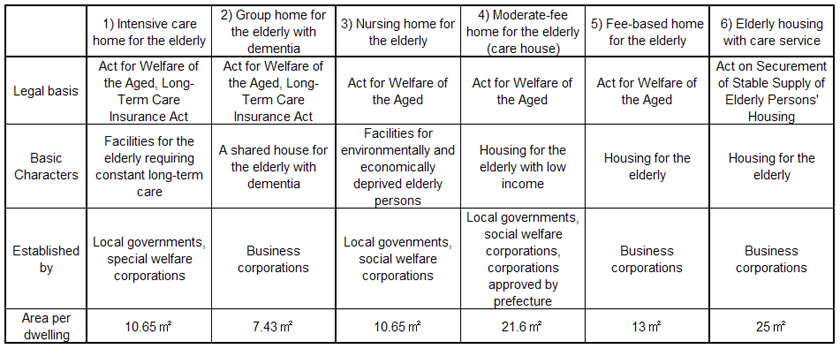

Table 5.1 shows the outline of housing services for the elderly; 1) intensive care home, 2) group home for dementia person, 3) nursing home, 4) moderate-fee home, 5) fee based home, and 6) elderly housing with care services.

Intensive Care Home for the elderly is a day-care facility for persons aged 65 years and over who require constant nursing care services due to serious physical or mental disabilities. This service is provided mainly by the Long-Term Care Insurance benefits. Group homes for the elderly with dementia is a small facility in which dementia patients live together and receive care and supports with a homely atmosphere under the Long-Term Care Insurance. The capacity of a group home is defined as 5-9 persons.

However, based on the conventional system defined by the Act on Social Welfare Service for Elderly, institutional services for the elderly are still provided. The nursing homes for the elderly are admission-type facilities for economically deprived elderly. In addition, moderate-fee homes for the elderly (care houses) provide residence and support services including meal services at low-cost.

In recent years, there are more fee-based homes for the elderly run by the private sector. These are considered as housing facilities rather than social welfare facilities for the elderly. When the elderly enters a contract with a service provider of fee-based home, they must pay the full expense by themselves, which sometimes causes financial trouble between a provider and a resident. The in-home service provided by the long-term care insurance can be used at these facilities.

Elderly housing with care services introduced in 2011 are run by the private sector, and required to register with the prefecture. The criteria for registration are (1) dwelling floor area 25 m2 or more per dwelling unit in principle and barrier-free design, (2) provision of services including safety confirmation and daily life consultation, (3) extra consideration on contract to secure residence in case of long hospitalization, etc. There are subsidies to promote elderly housing with care services, and 3,478 buildings comprised of 111,966 units are registered by May 2013.

Alternatively, Silver Housing has been developed jointly by the Ministry of Health, Labour and Welfare and the Ministry of Land, Infrastructure, Transport and Tourism since 1986. It is a collective housing for single-person and married-couple households aged 60 years old and over, and usually Life Support Advisors are attached on site for counseling, consultation, safety confirmation, temporary home help, and emergency response. There is also public housing for low income households, and some of them are purpose-built for the elderly or disabled persons.

Table 5.1 The outline of housing service for the elderly

Source: Ministry of Health, Labour and Welfare (2013), The current situation and the future direction of the Long-term Care Insurance System in Japan: with a focus on the housing for the elderly.

(

http://www.mhlw.go.jp/english/policy/care-welfare/care-welfare-elderly/dl/ri_130311-01.pdf)

5.4.2 Five-year plan to support for people with dementia

In 2012 the Ministry of Health, Labour and Welfare published “Future Directions of Dementia Support,” and announced the five-year strategic plan to support people with dementia. This plan aims to create a society that respects dignity and makes people able to live in a familiar environment in the community as long as possible, even if they have dementia. In order to achieve the goal, the Ministry positively pursues new programs to change the conventional culture of care which often treats people with dementia to be in a psychiatric hospital or facility. The programs include newly developed standard care paths for dementia, early diagnosis and treatment, appropriate health and long-term care services to support living in the community, enhanced livelihood support for the persons with dementia and their family members, and personnel training.

5.4.3 Prevention of elderly abuse

Act on the Prevention of Elder Abuse, Support for Caregivers of Elderly Persons and Other Related Matters was enacted in 2005 for respecting the dignity of the elderly, preventing abuse, protecting those abused, and supporting caregivers. The Act defines that the elderly abuse includes abusive behavior by both family members and care workers. It specifies that municipalities are primarily responsible for implementing abuse prevention programs, while prefectures take the role in liaison and coordination of municipalities, collection and provision of information, and construction of facilities.

The following items are emphasized as the fundamental perspectives of abuse prevention program; (1) seamless supports from prevention of abuse to recovery from abuse (2) respect for the elderly persons’ own decision making, (3) positive approaches to abuse prevention, (4) early detection and protection, (5) support for the elderly and their caregivers, (6) collaboration and cooperation of related organizations.

5.4.4 Relationship with other public care and support services

In regard to the relationship between the long-term care insurance and elderly services under the Services and Supports for Persons with Disabilities Act or Public Assistance, benefits of the Long-term Care Insurance Act have priority according the principle of placing priority on insurance. The services such as hearing aid, prosthetic hand/leg which are not covered by the long-term care insurance, are provided to the elderly with disabilities according to the Services and Supports for Persons with Disabilities Act. With regard to Public Assistance, for the extreme poor elderly, the benefits of the long-term care insurance are given priority, and the co-payment portion is covered by the Public Assistance system.