2.1 History of the social security system in Japan

2.1.1 Pre-Modern Era (before 1868)

As with other countries, the source of social security in Japan could be found in charity-oriented communal activities for the poor in a pre-modern era. The “Shikain(四箇院)” (four institutions for the frail elderly without family etc.) set up in 539 was an example of it. The Imperial court, Shogunate, and feudal lords had provided relief to the poor. Buddhist temples also had provided relief to them. These measures were based on the charity ethics of Confucianism and Buddhism. However, the beneficiaries had been severely limited (ex. the poor elderly without family). It was because the mutual aid had been a principal of the society in those days. For example, “Gonin-gumi(五人組)” (five members group in the Edo Era) might not only be a group for the render (Nengu 年貢) payment, but also that of mutual aid in the community during this era. This can be one form of the social capital of the pre-modern society.

As for the healthcare, during the time from the ancient to the Edo Period, traditional medicine had been imported from the Chinese continent, with certain original development within Japan. In the latter period of Edo, western medicine had been imported from the Netherlands through Nagasaki. Private schools (Rangaku Jyuku 蘭学塾) had been set up in Nagasaki and Sakura (Chiba) etc. Some of them are the origins of the notable medical faculties of the University of the present time.

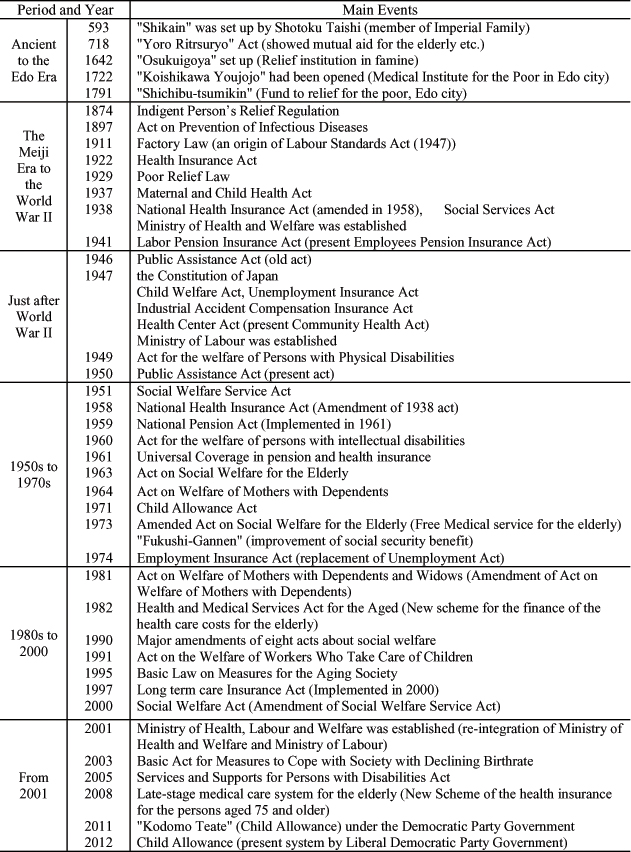

Annex Table 2.1 in page 10 lists the detailed chronological events.

2.1.2 From the Meiji Era to the End of World War II (1868-1945)

In the Meiji Era (1868-1912), Japan had started to develop for modernization. But poverty had increased because of instability in society. The government had to cope with it. Indigent Person’s Relief Regulation had been enacted (1884). But this regulation had a principle of “mutual aid for the poor” and the beneficiaries were severely limited. The amendment of it to expand the beneficiaries had been discussed in the Imperial Parliament, but we had to wait for the enactment of the Poor Relief Law (1929). It was still an inadequate system compared to the present system.

In the Meiji Era and the Taisho Era (1912-1926), poor health and bad working conditions of the factory workers including boys, girls, and women had been a serious social problem. It had led to the introduction of the Factory Law (1911). This law is an origin of Labour Standards Act (1947). After that, a social insurance scheme was introduced for workers. These were Health Insurance Act (1927), National Health Insurance Act (1938), Labor Pension Insurance Act (1941). During this period, the Ministry of Health and Welfare was established in 1938. Social welfare, health care, public health, and labour policy had been transferred from the Home Ministry. Local governments also had made efforts to cope with poverty. Commissioned welfare volunteer had been introduced in Okayama prefecture (Saisei-komon-seido in 1917) and Osaka prefecture (Houmen-iin-seido in 1919). This system had been spread throughout Japan and has led to the present welfare commissioner and commissioned child welfare volunteers. In addition to these, many charitable persons had set up welfare institutions like orphanages, facilities for the mentally disabled persons, and nursing homes for the elderly.

However, these systems were inadequate compared to the present system in terms of population coverage and so on. (Refer to Annex Table 2.1)

In terms of medicine, the Meiji government had decided to introduce western medicine (mainly from Germany) and had developed the medical doctor license qualification system, educational institutions, and so on. The government also had constructed the mechanism of modern public health (for example, Act on Prevention of Infectious Diseases in 1897). Maternal and Child Health Act has been enacted in 1937. Based on this act, “Maternal Handbook” (present “Maternal and Child Health Handbook”) had been issued from 1942. The purpose of this handbook was to protect and promote the health of mother and child through recording the health checkup. (Refer to Annex Table 2.1)

2.1.3 After the End of World War II to present (1945-2013)

The social security system in Japan developed dramatically after the end of World War II. During the social turmoil just after the World War II, measures to assist the needy, to improve nutrition and to prevent infectious diseases were implemented, along with infrastructure development related to social welfare policies. In the Constitution of Japan enacted in 1947, Article 25 stipulates the fundamental principles of developing a social security system, and this served as the foundation for social security-related laws created in the post war era. In 1947, the Ministry of Labour had been separated from the Ministry of Health and Welfare to be in charge of labor policy independently (These ministries have been re-integrated in 2001 as the Ministry of Health, Labour and Welfare). In this year, unemployment insurance had been introduced.

During the rapid economic growth period that followed, the public pension and health insurance was expanded to cover more people, and the so-called “Universal Coverage in public pension and health insurance” extending to all citizens was introduced in 1961. The Act on Social Welfare Service for Elderly and the Maternal and Child Welfare Act were also enacted in 1963 and 1964 respectively, and benefits from various systems were enhanced. The social security system was reviewed during the period of stable economic growth since the late 1970s. Meanwhile, developing a social security system in response to the aging population became an important challenge.

Since the 1990s, measures against the declining birthrate, in addition to the aging society, surfaced as an important policy issue. Pension and health insurance system reforms were implemented. Long-Term Care Insurance Act was introduced to support the elderly with long-term care needs and their family by the society. Enhancement of childcare services and financial support are being promoted to assist child care. In addition, due to changes in the employment situation and widening difference in economy, employment policies have also become important. (Refer to Annex Table 2.1)

2.2 Social security schemes in Japan and its characteristics

A social security scheme is primarily a system that supports the livelihood of the people by providing necessary support against conditions that lead to poverty, illness, injury, death, aging and unemployment, and so on. There are various social security schemes in Japan. The public pension system is to provide income security for the elderly, the survivors, and disabled persons. Healthcare systems to protect public health include the health insurance, public health and maternal and child health systems. Meanwhile, social welfare for the elderly include long-term care insurance, while family policies include childcare services and financial support such as child allowance, and support for single-parent households. Policies for persons with disabilities include the provision of care services and financial support. Public assistance is available as part of the financial support system for the poor. As part of the system to protect workers, employment insurance, work-related accident insurance, and others are available.

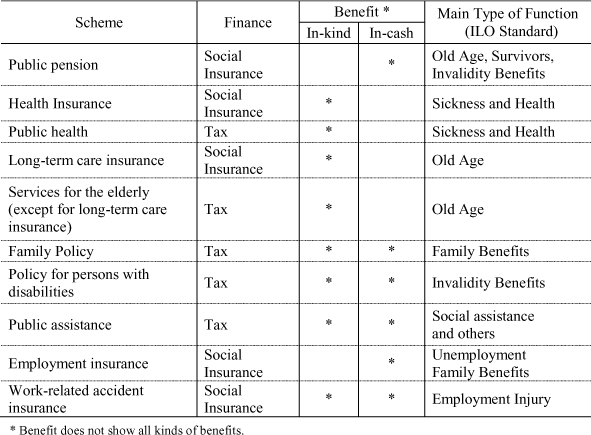

Kinds of benefits provided through these social security schemes are either in-kind or in-cash. Table 2.1 lists major social security schemes by types of benefits and in-kind/in-cash classification based on International Labour Organization (ILO) classification standard.

Table 2.1 Schemes of Social Security

Many social security schemes in Japan adopt the social insurance system. There are five social insurance systems, namely the public pension, health insurance, long-term care insurance, employment insurance, and work-related accident insurance. Of these insurances, all citizens are enrolled in the public pension and health insurance programs. This universal coverage in public pension and health insurance is a main characteristic of the Japanese social security system. Furthermore, citizens aged 40 and over are covered by the long-term care insurance, and employees are covered by the employment insurance and work-related accident insurance.

The social insurance systems mentioned above are financed by social insurance premiums and supplemented by the tax revenue in forms of subsidy. The social insurance premiums is shared by all insured, in most cases, according to their ability to pay (the level of income). Thus, the function of social insurance is to share the risk among insured persons, and at the same time, to redistribute income among them.

On the other hand, other schemes, such as public assistance (poverty alleviation measures in Japan), services/benefits for the family, children, and the disabled are paid out of the general budget of the government (tax).

2.3 Administration organizations and service providers

The Ministry of Health, Labour and Welfare holds jurisdiction over the social security systems. The Ministry sets national standards and promotes projects deemed necessary to be implemented from a national perspective. The Cabinet Office is in charge of planning the governmental basic policy plans related to social security such as population aging and child care policy and so on. Local governments such as prefectures and notably municipalities (cities, towns and villages) execute and implement the social security services. Local governments have social welfare office, public health centers. In recent years, decentralization proceeds in the form of delegating the financial resources from central to local governments. It is based on the idea of “Local autonomy.”

Social security system has many schemes. Managements of beneficiaries and contributions has been done separately only to lead to inconvenience for people and inefficiency in management. To solve these problems, the Social Security and Tax Number Law was approved in 2013 and planned to be enacted in January 2016. A unique number will be given to all persons, including foreign residents, and companies in Japan. Keeping the maximum attention to the privacy protection, this “My Number” system will be used for service management in the tax and social security.

Service providers of social security such as hospitals and clinics for health care, day-care centers and institutions for the elderly long-term care, rehabilitation centers and support centers for the disabled, and so forth, can be both public and private. However, private institutions are not allowed to gain profit and distribute it. Public and private institutions are both operated under the supervision of the Ministry of Health, Labour and Welfare (MHLW) and the local governments.

2.4 Financial statistics of social security

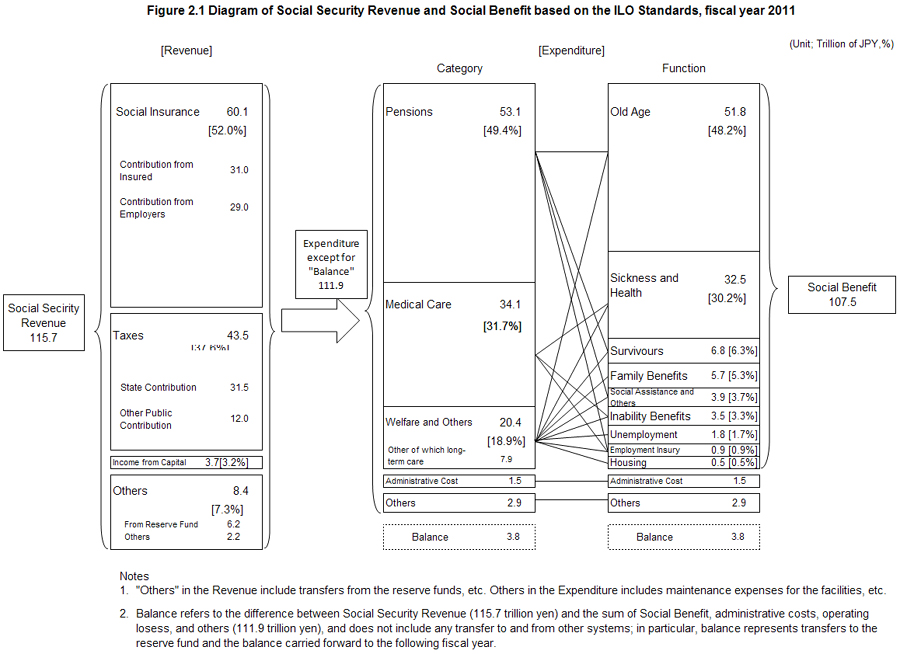

Japan now collects and spends two sets of financial statistics of social security. The Social Expenditure of Japan based on the OECD standard was 112.0437 trillion JPY in FY2011, which was 23.67% to GDP and 876,700 JPY per capita. The Social Benefit based on ILO standard, which does not include facility maintenance costs, pre-school education costs and so on, was 107.4950 trillion JPY in FY2011 which was 22.71% to GDP and 841,100 JPY per capita. The ILO standard social security statistics can grasp the flow of revenue and expenditure in social security. Fig. 2.1 shows a breakdown of social security revenue and expenditure by this ILO standard. Insurance premium accounts for 52.0% of the total revenue and the taxes for 37.6%. The expenditure for the public pension takes up around half of the entire expenditure, and for the medical care, around one third. As for the expenditure by function, old age takes up around 50 %.

Annex Table 2.1. History of Social Security in Japan